Otis Worldwide (OTIS)·Q4 2025 Earnings Summary

Otis Q4 2025: Service Flywheel Delivers Record Mod Backlog as China Weighs on Outlook

January 28, 2026 · by Fintool AI Agent

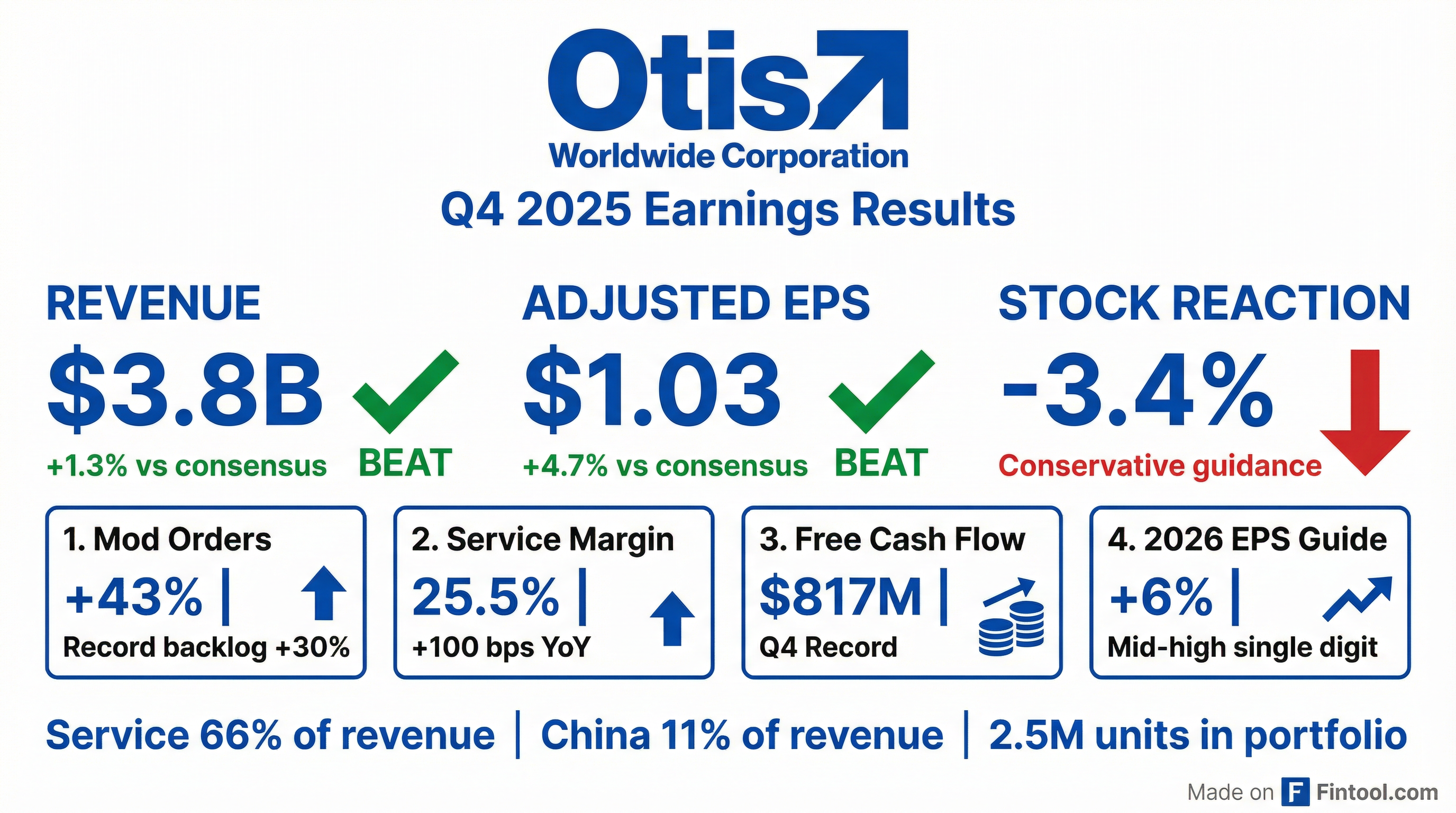

Otis Worldwide delivered a strong Q4 2025 with adjusted EPS of $1.03 (+11% YoY) beating consensus and revenue of $3.8 billion also topping estimates. The highlight was modernization orders surging 43% to a record backlog, positioning the company for sustained Service growth. However, shares fell 3.4% as investors focused on conservative 2026 guidance and ongoing China headwinds.

Did Otis Beat Earnings in Q4 2025?

Adjusted EPS: Beat | Revenue: Beat | Stock: Down 3.4%

*Values retrieved from S&P Global

Adjusted EPS grew 11%—the highest level of the year and strongest performance in the last 6 quarters—driven by Service margin expansion and favorable FX.

What Drove the Quarter?

Service Segment: The Growth Engine

The Service segment delivered another exceptional quarter, with all lines of business contributing:

*Note: Q4 service margin included a $14M one-time gain from service center sales as Otis outsources spare parts logistics to improve delivery times. Excluding this, underlying margin expansion was 40 bps.

Modernization was the standout: Orders surged 43% at constant currency with backlog up 30%—the highest since spin. Management noted this positions them "well for 2026 and beyond" with revenue growth expected "in the teens" going forward.

"We are just scratching the surface of the modernization opportunity ahead. As units from past construction cycles continue to age, they should create a durable multi-year tailwind." — Christina Mendez, CFO

China mod outperformance: Due to the Mod bond stimulus program, China mod revenue grew +100% YoY in Q4 and +75% for FY 2025, with orders up 35%+ for the year.

Key customer wins in the quarter:

- Dallas Children's Hospital: 39 elevators including 26 SkyRise units with Otis ONE Pro

- Shanghai Metro Line 19: 490+ heavy-duty public escalators with real-time monitoring

- London Underground: Comprehensive 172 escalator service and modernization program

- Kuala Lumpur Armani Residence KLCC: 26 SkyRise elevator systems with Compass 360 destination management and Otis ONE IoT

New Equipment Segment: China Drag Continues

New Equipment remained under pressure with organic sales down 6%:

Regional divergence was stark:

- EMEA: +6% organic (strength in Middle East, Southern Europe)

- Asia Pacific ex-China: Low single digits (India, Japan growth)

- Americas: -5% (timing of project execution)

- China: >20% decline

Importantly, NE backlog turned positive for the first time in 7 quarters, up 2% overall and +9% excluding China.

What Did Management Guide for 2026?

Otis provided full-year guidance reflecting continued Service momentum offset by China headwinds:

Q1 2026 guidance: EPS roughly flat YoY

"We chose to be conservative... we want to make sure that what we commit, we deliver." — Judy Marks, CEO

What Changed From Last Quarter?

Positive Shifts

- Modernization acceleration: Orders +43% vs +27% in Q3

- Record free cash flow: $817M in Q4, best Q4 since 2016

- NE backlog inflection: First positive growth in 7 quarters

- Mod margins improving: Up 50 bps Q/Q, approaching 10% target

- Retention stabilized: Ex-China retention rate stopped eroding

- Gen3 product launch: New elevator family in EMEA with enhanced IoT connectivity

Concerns Persist

- Conservative guidance: Mid-to-high single digit EPS growth below some expectations

- China structural headwinds: Annual contract renewals create ongoing churn

- China pricing pressure: Expect -1-2 points sequentially Q/Q; rest of world "good"

- Service investment drag: Excellence investments temporarily weighing on margins

Q&A Highlights: What Analysts Focused On

Repair Growth Expectations

Management guided repair revenue to accelerate to 10%+ in 2026, up from 5% in 2025. Combined with maintenance improvement, this should drive 1-2 points higher Service organic growth.

"We are expecting our repair rates to ramp up to be 10%+. That will bring maintenance and repair up higher, and we're actually expecting at least a point gain in maintenance as well." — Judy Marks

Modernization Conversion Cycle

Analysts questioned the gap between strong mod orders (+43%) and revenue (+9%). Management explained the mix includes multi-year major projects (like London Underground) that convert slowly, alongside faster-turning volume work:

"You won't see us convert that 30% [backlog], I know for sure in 2026, because there are multi-year major projects in there... But planning it in the teens, if not more, is an appropriate place to plan." — Judy Marks

China Strategy and Conversion Rates

Steve Tusa (JPMorgan) pressed on China's lower conversion rate (new equipment to service). Management confirmed this is strategic—Otis is deliberately walking away from lower-value units in tier 3/4 cities:

"We want the units that will give us the lifetime service or certainly a better service stickiness. In service recaptures, we're very targeted now... it might impact the rate, but it will give us a healthier portfolio in China." — Judy Marks

Service Excellence Investment Payback

Several analysts questioned when service investments would yield results. Management indicated retention has stabilized ex-China, with improvement expected in 2026-2028:

"Our goal in 2025 was to stabilize that retention rate after seeing a decline from 2024 to 2025. Ex-China, we've done that, and now we expect small growth to start yielding in 2026." — Judy Marks

How Did the Stock React?

OTIS shares fell 3.4% on the day, dropping from $90.55 to $86.88 despite the EPS and revenue beats.

The negative reaction reflects:

- Conservative 2026 guidance: Mid-to-high single digit EPS growth at midpoint of ~6% below some expectations

- Q1 guidance for flat EPS: Suggests back-half weighted year

- China uncertainty: No clear catalyst for market stabilization

Year-to-date, OTIS is now down 9% from its 52-week high of $106.83.

Deep Dive: China Market Dynamics

Management provided extensive China color:

China transformation progress:

- Service now 47% of China revenue (up from 42% in Q3, mid-teens at spin)

- China represents only 11% of total Otis revenue

- Connected units growing, subscription revenue +35% globally

Mod bond stimulus program: Government-funded modernization ramped from 80K units (2024) to 120K units (2025), expected to continue at "at least" 2025 levels in 2026.

Full Year 2025 Summary

Margin expansion of 30+ bps every year since spin demonstrates consistent operational execution.

Capital Allocation

Otis maintained its balanced capital allocation strategy:

- Share repurchases: ~$800 million planned for 2026

- Dividend payout: 40% target ratio

- Bolt-on M&A: ~$100 million in 2025

"We will continue with our shareholder-oriented capital allocation strategy... We will remain flexible with other potential investments, including bolt-on acquisitions." — Christina Mendez

Key Takeaways

-

Service flywheel working: 5% organic growth, 100 bps margin expansion, record mod backlog validates the strategic pivot

-

Modernization is the growth story: 43% order growth, 30% backlog growth, "evergreen" opportunity as aged units cycle through

-

China is manageable: Now only 11% of revenue, service transformation progressing, strategic discipline on unit quality

-

Guidance is conservative: Management explicitly chose caution; operational momentum is stronger than 6% EPS growth implies

-

Connected ecosystem building: 1.1M units connected, subscription revenue +35%, AI tools and predictive maintenance expanding

View OTIS Company Profile · Q3 2025 Earnings · Earnings Call Transcript p/research/companies/OTIS/earnings/Q3%202025) · Earnings Call Transcript*